What is cfd trading

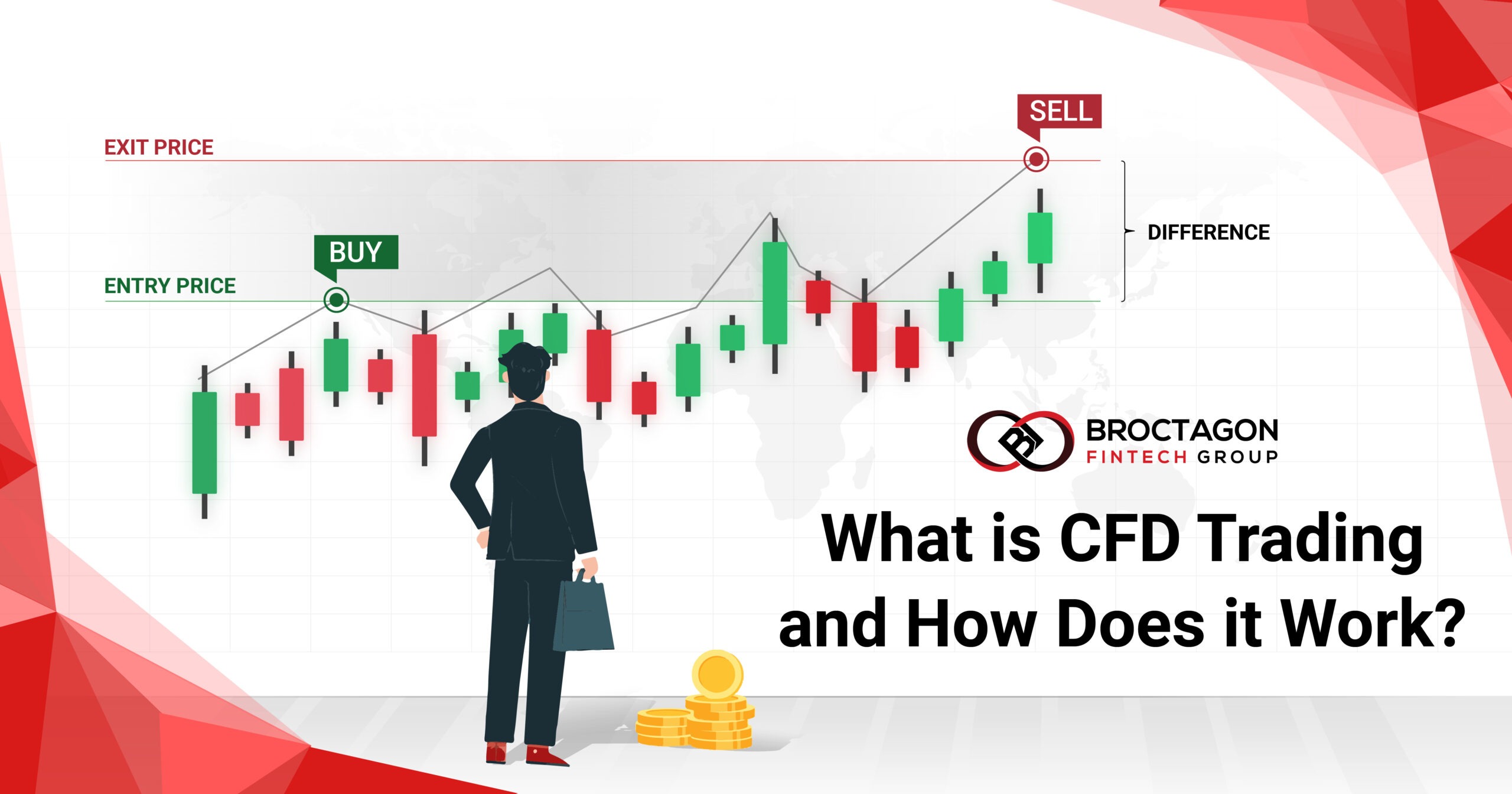

A CFD is a leveraged derivatives product that tracks the price movement of an underlying instrument. Essentially, a CFD is a contract an investor enters into with a CFD provider to gain exposure to an underlying instrument whereby differences between the closing and the opening value will be settled through cash payments without owning the underlying instruments

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage Versus Trade. Between 51% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Read more on forex trading risks.

CFD traders do not enjoy any such ownership rights. When you use a trading platform to purchase a CFD, you do not own (or take delivery of) the actual underlying asset. CFDs are tradeable derivative instruments that reflect the price of an underlying asset – such as stocks.

Cfd meaning in trading

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

CFDs allow investors to easily take a long or short position or a buy and sell position. The CFD market typically doesn’t have short-selling rules. An instrument may be shorted at any time. There’s no borrowing or shorting cost because there’s no ownership of the underlying asset.

The combination of spread costs, overnight financing charges, limited regulatory protection, and amplified losses through leverage means CFDs are best suited for knowledgeable traders with robust risk management strategies and enough capital to withstand drawdowns. Regulatory bodies worldwide have recognized these risks, with the European Securities and Markets Authority putting more protective measures in place for retail investors and the SEC prohibiting CFD trading for American retail traders entirely.

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

CFDs allow investors to easily take a long or short position or a buy and sell position. The CFD market typically doesn’t have short-selling rules. An instrument may be shorted at any time. There’s no borrowing or shorting cost because there’s no ownership of the underlying asset.

Cfd trading platform

Fractional shares on CFD indices: Saxo offers fractional share trading on CFD indices, with the ability to purchase 0.01 of the default contract size for the index. Saxo also offers portfolio-based margin which can enhance the potential leverage and thus the risk/reward ratio – though this iis reserved for clients designated as professional traders. Check out my guide to the best high-leverage forex brokers to learn more about leverage can be used when trading forex and CFDs.

eToro’s Social Trading features can provide new CFD traders with a blueprint for implementing this tricky strategy – learning from more experienced traders in eToro’s vast social network who share their trade ideas.

For example, if a trader buys a CFD on the EUR/USD pair and the contract price moves higher than the initial purchase price, the unrealized profit will be the difference between those two prices (minus any applicable trading costs).

Since CFD trading opportunities are often fleeting, transactions need to be executed quickly. Make sure a broker you are considering has quick transaction times for clients based in your locale and that issues like order slippage and requotes are minimal. You can test execution speeds by making small transactions in a live account.